The outlook for private equity

LISTED PRIVATE EQUITY; PRIVATE EQUITY REIMAGINED

In the final instalment of our 4-part series Listed Private Equity: Private Equity Reimagined, Consulting Economist Steven Milch considers the outlook for private equity. Private Equity allocations have increased over recent years, with this trend expected to remain a theme, supported by influences such as near-zero interest rates, elevated valuations in traditional markets and the opportunities presented by emerging markets, innovation and disruption. At the same time, long term return expectations continue to favour private equity relative to equities.

PRIVATE EQUITY ASSET ALLOCATIONS ARE INCREASING

The post-GFC macroeconomic environment brought about not only significant shifts in financial markets but also in investment strategies. Supported by factors such as near-zero global interest rates, investors globally – from pension funds to sovereign wealth funds and family offices – have increased allocations to private market assets[1] in order to enhance returns and add diversification.

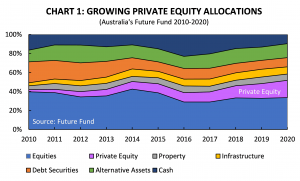

An example is provided by Australia’s $162bn Future Fund. Chart 1 shows the shift in the Future Fund’s asset allocation over the past decade, including a steady increase in the proportion allocated to Private Equity from 2% in 2010 to 18% in 2020. Funding this (and smaller increases to Infrastructure, Property and other Alternatives) have been reduced allocations to Debt Securities or Bonds (-12%), Cash (-7%) and Equities (-6%).

CHART 1: GROWING PRIVATE EQUITY ALLOCATIONS

The continued search for return

With more than a decade having passed since the GFC, it could perhaps be argued that the trends of increasing PE allocations and favourable returns may have run their course. On the contrary, however, we argue that these trends are likely to continue to play out, supported by the following influences.

- While near-zero rates have been a feature of many advanced economies at various times since the GFC, they have only reached such levels in Australia in early 2020, implying a period of adjustment going forward.

- Similarly, with the RBA now targeting low bond yields (the 3-year target currently at 25bp) as well as the cash rate, the options for low risk, income earning assets have substantially diminished.

- Bonds are, therefore, seen as shifting from offering the attractive risk-adjusted returns of recent decades (as observed in Part 1 of our series) to providing substantially lower returns, without commensurately lower risk. Indeed, the Blackrock[2] 10-year return expectation for Australian government bonds is just 0.9% per annum and, for Australian corporate bonds, is 1.7% per annum.

- The COVID-19 recession has, counterintuitively, also seen broad equity market valuations move higher as global monetary and fiscal easing supports liquidity and financial market sentiment. Chart 2 shows this by means of Australia’s 3 Year government bond yield (currently trading only slightly above zero) and the Price/Earnings ratio on the S&P500 index (which stands around a 20-year high). Such elevated valuations are expected to be reflected in lower long term returns for equities and bonds.

The developments above are expected to drive portfolio managers to further reassess their strategic (or long term) and tactical (short to medium term) asset allocations as they search for attractive risk-adjusted returns as well as sources of diversification – both of which are features of private equity and listed private equity, as we have discussed throughout this series.

CHART 2: BOND & EQUITY VALUATIONS ARE STRETCHED

Disruption and innovation create opportunity

Looking beyond the current macroeconomics, in a recent annual study of the long-term investment outlook, JP Morgan highlights a number of structural influences that are expected to support an “acceleration in the pace and scope of private equity opportunities”[3]. Among these are a) the geographic expansion of PE investment opportunities, particularly in emerging markets, and b) the opportunities created by innovation, disruption and the digital economy.

Private equity is not without its headwinds, however. Rising PE allocations have led to an accumulation of cash to be invested – potentially lifting price multiples on underlying assets which may, in turn, curb excess returns.

Balancing the above influences, the study concludes that “the strategic economic and financial market environment provides a positive backdrop for the opportunistic operating format of private equity”. Furthermore, like Blackrock (as discussed in Part 3) J.P. Morgan assign a higher long term return expectation to private equity than to global shares (8.8% per annum versus 6.5%). Here, however, we note J.P. Morgan’s more conservative private equity outlook compared to Blackrock’s (8.8% per annum versus 12.4%).

Summary and conclusion

To summarise, our series has taken an extensive tour of private equity.

- Part 1 explored the challenges and attractions of private equity investing, including the outperformance and diversification benefits offered by the asset class.

- Part 2 discussed the emergence of listed private equity – which successfully addresses aspects of traditional private equity, such as illiquidity, which have previously deterred investors.

- Part 3 showed how, with a proven private equity manager in place, listed PE securities can consistently trade at a premium above net asset value.

- Part 4 has discussed the trend of rising PE allocations and the favourable PE return outlook – each supported by the economic backdrop as well as a number of long term structural themes.

Finally, the research reveals a “strong positive relationship between the allocation to private investments and portfolio return” [4] warranting careful consideration of private equity and, in particular, listed private equity. However, as investors look to the asset class to provide the benefits of return and diversification “thoughtful allocation and prudent selection of top-tier managers remain critical”[5].

REFERENCES

Blackrock Investment Institute, Capital Market Assumptions, August 2020, < https://www.blackrock.com/institutions/en-zz/insights/charts/capital-market-assumptions>.

Cambridge Associates, “The 15% Frontier, 2016, < https://www.cambridgeassociates.com/insight/the-15-percent-frontier/>.

Future Fund Portfolio updates, 2010-2020, <https://futurefund.gov.au/investment/investment-performance/portfolio-updates>.

J.P. Morgan Asset Management, “Long-Term Capital Market Assumptions”, 2020.

Papaioannou, M.G. and Rentsendorj, B., “Sovereign Wealth Fund Investment Performance, Strategic Asset Allocation, and Funding Withdrawal Rules” in Bulusu, N., Coche, J., Reveiz, A., Rivadeneyra, F., Sahakyan, V. and Yanou, G. eds, Advances in the Practice of Public Investment Management, 2018, Chapter 4, pp. 73-79.

ABOUT THE AUTHOR

Steven Milch

With a career as an economist and institutional investor spanning over 30 years Steven Milch (M Ec, B Comm Hons) has accumulated extensive financial market experience and a unique breadth of knowledge.

Steven currently holds postgraduate teaching positions with the University of New South Wales and Kaplan Business School. He manages assets in the not-for-profit sector and acts as Pengana Capital’s Consulting Economist.

Previously, Steven was Chief Economist and Head of Investments for the Suncorp Group. In this capacity, he led the Group’s Investment Research and Economics function and supervised the management of $21 billion of investment portfolios, focussing on asset allocation, manager selection and responsible investment initiatives.

Before joining Suncorp, Steven held the position of Chief Economist, St.George Bank. Steven has also worked at the Reserve Bank of Australia and has owned a successful investment advisory business. Steven is an investor in the Pengana Private Equity Trust (ARSN 630 923 643) (“PE1”).

IMPORTANT INFORMATION

Pengana Investment Management Limited (ABN 69 063 081 612, AFSL 219 462) (“Pengana”) is the issuer of units in PE1. A Product Disclosure Statement for PE1 (“PDS”) is available and can be obtained by contacting Pengana on (02) 8524 9900 or from www.pengana.com. A person who is considering investing in PE1 should obtain a copy of the PDS and should consider the PDS carefully and consult with their financial adviser to determine whether PE1 is appropriate for them before deciding whether to invest in, or to continue to hold, units in PE1. This report was prepared by Pengana and does not contain any investment recommendation or investment advice. None of Pengana, Grosvenor Capital Management, L.P., nor any of their related entities, directors, partners or officers guarantees the performance of, or the repayment of capital, or income invested in PE1. An investment in PE1 is subject to investment risk including a possible delay in repayment and loss of income and principal invested. Past performance is not a reliable indicator of future performance, the value of investments can go up and down

[1] Papaioannou and Rentsendorj (2018).

[2] BlackRock Investment Institute (2020).

[3] J.P. Morgan Asset Management (2020).

[4] Cambridge Associates (2016), p.3.

[5] J.P. Morgan Asset Management (2020), p.73.