Healthy returns from health care companies

Slowing consumer spending impacts corporate earnings growth across much of the economy. However, health care profits are often driven by other factors, offering potentially great investments even if economic growth stalls.

WHAT IS HEALTH CARE?

Health care can be a great portfolio diversifier as it is fairly immune to fluctuations in the business cycle, and lightly correlated to the broader share market.

Revenues in the health care sector are growing as the population ages and governments increase public health spending following Covid learnings.

The health care sector includes:

- Biotechnology and pharmaceuticals – drugs and vaccines

- Life sciences – analytical tools and clinical testing

- Equipment suppliers – thermometers to MRI machines

- Health care providers – medical facilities

- Health care technology – research and development (R&D)

Health care earnings are primarily driven by product cycles rather than the economy. A newly authorised therapeutic that addresses an unmet medical need can be highly profitable at any point in the business cycle. This is because costs are usually met by insurance companies or public health systems rather than end consumers.

BIOTECH

Research and Development is shifting from traditional pharmaceuticals (small molecule drugs derived chemically) to biotech (large molecule drugs derived from organisms). Structurally the same as human compounds, biotech drugs potentially cure diseases rather than just treating symptoms.

The World Health Organisation reports1 that an estimated 650 million people worldwide are obese, accounting for 5% of all global deaths. Advances in biotechnology have led to breakthroughs in the treatment of diseases such as obesity and diabetes

“A newly authorised therapeutic that addresses an unmet medical need can be highly profitableat any point in the business cycle.”

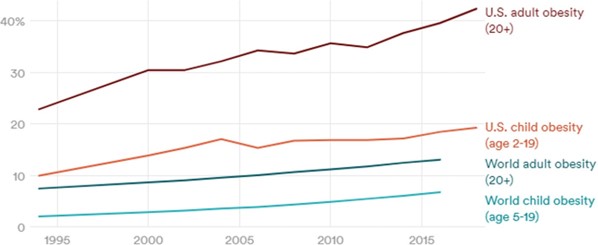

Obesity is a growing problem affecting four in ten Americans, which carries an increased risk of comorbid and chronic conditions such as type two diabetes, cancer and heart disease.

Obesity is a growing problem affecting four in ten Americans, which carries an increased risk of comorbid and chronic conditions such as type two diabetes, cancer and heart disease.

Rise in US and global obesity as a percentage of the population

Source: J. Emory Parker, STAT/National Centre for Health Statistics (US), World Health Organisation (world)

The annual market for obesity drugs is forecast to expand from US$2.4 billion in 2022 to US$54 billion by 2030.2

Sales of obesity drugs are expected to continue to soar as growth in the global middle class brings changing dietary patterns. This will benefit Novo Nordisk and Eli Lilly which dominate the market and have doubled their market values over the last 12 and 24 months respectively.

LIFE SCIENCES

Drugs such as Novo Nordisk’s obesity product Wegovy, which is made from fermenting yeast, are increasingly being developed from biologic processes . This boosts demand for biologic tools, including bioreactors, filtration devices and chromatography equipment.

Demand for point-of-care testing (POCT) in hospitals is growing. POCT provides immediate results without the delay incurred in laboratory analysis, supporting more rapid clinical diagnosis and treatment. Consumables represent 70% of POCT expenditure, delivering recurring revenue streams.

US life sciences group Danaher supplies key vaccine components, research equipment and diagnostics in addition to biotech and POCT equipment. This is after successfully integrating some astute acquisitions, helping double its market value over the last four years.

VETERINARY CARE

Companies that provide pet treatments represent a unique part of the healthcare system as revenues largely depend on the end user (or rather their owners). However, this is a particularly resilient area of consumer spending, as households prioritise the well-being of their four-legged family members.

Zoetis is the world’s largest producer of animal medicines and vaccinations, focussing on higher margin pet treatments. Market leading positions in drugs to treat parasites and arthritic pain are expected to power earnings growth for years to come. This has helped its market value to double over the last four years.

The frequency of vet visits has soared in recent years, driving demand for specialised diagnostics equipment and software. IDEXX Laboratories holds a market leading position in a sector which continues to grow independently of consumer spending, driving an almost 50% increase in market value over the last six months.

- WHO, World Obesity Day 2022 ‘Accelerating action to stop obesity’

- Morgan Stanley, ‘Why obesity drugs may be a new blockbuster pharma category’