Ethical investing – an every day priority?

Investors aim to maximise their returns but want to understand the impact companies in their portfolios have on the wider world. Axiom analyses ESG risks to better understand the resilience of business models. This helps manage those risks and build stronger portfolios which better align with investors’ values, especially when overlayed with an ethical framework.

ESG INVESTING

ESG investing considers a series of factors that give rise to risks (and sometimes opportunities) which impact long-term earnings and share prices. Managing ESG risks well can boost returns in the same way as managing other investment risks, (such as credit risk or operational risk).

Through drawing on ESG data, industry research, fundamental analysis and ongoing engagement with companies, investors construct portfolios which maximise risk- adjusted returns.

ETHICAL INVESTING

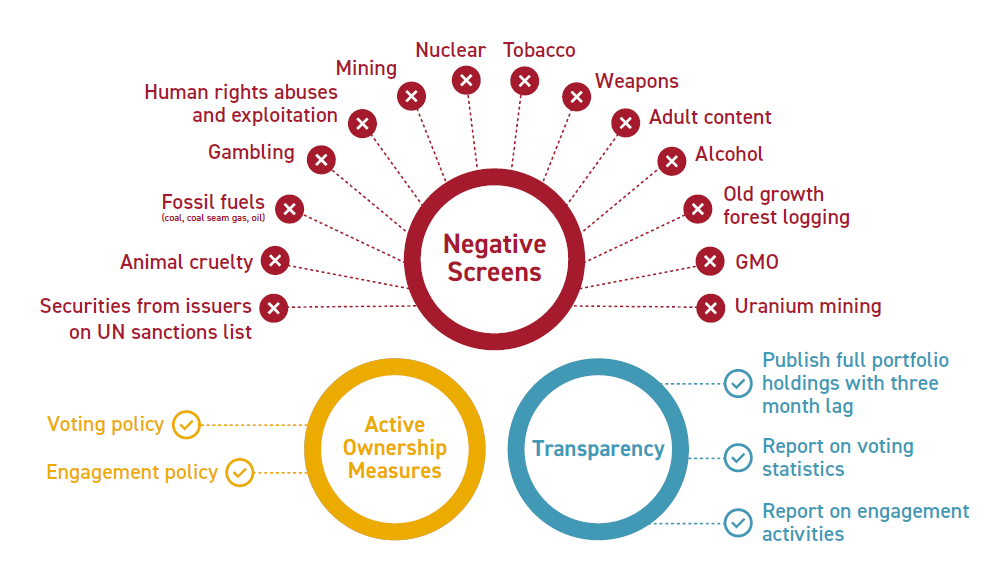

Ethical investors identify companies with business models, values, and products which are compatible with their own. The Pengana Axiom International Ethical Fund excludes companies engaged in activities defined by its twelve ethical screens.

*Material business involvement is generally considered to be over 5% of production of, or 15% aggregate revenue from, the production, distribution and retail of the screened product/service. For thresholds on each specific screen please refer to the Responsible Investment Policy at www.pengana.com/ethical-framework

Ethical companies align their brand values with those of their stakeholders, including customers, investors, employees (current and potential), suppliers, regulators, and the broader community.

It’s about the journey, not just the destination

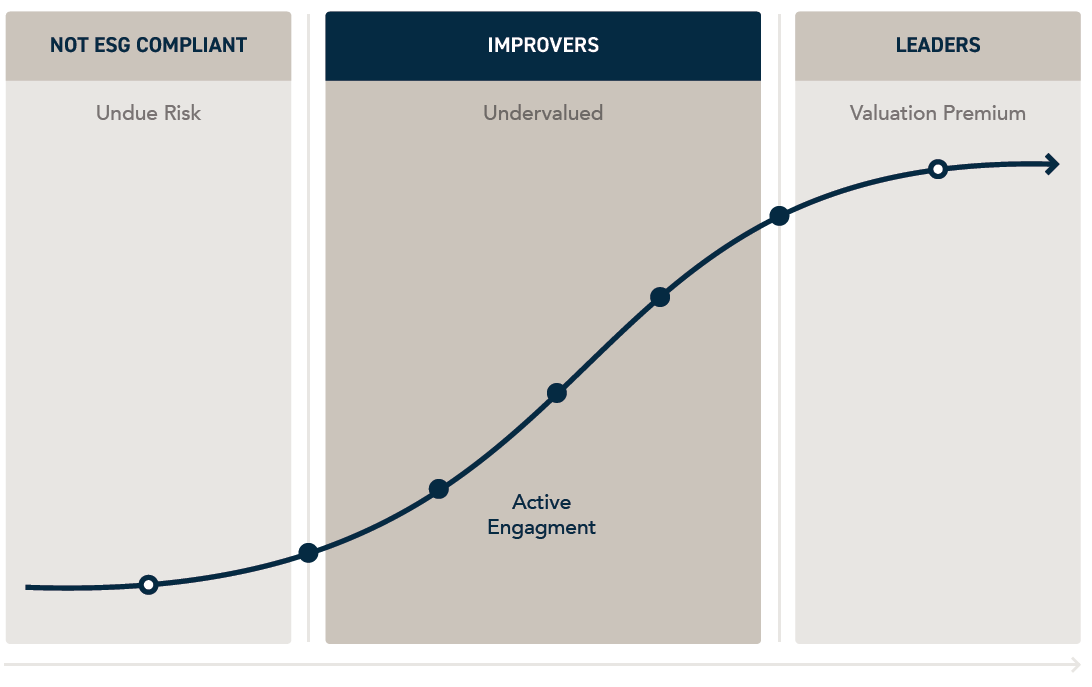

Companies which are actively improving their ESG characteristics tend to outperform not just the ESG laggards, but also ESG leaders. This is because it is unanticipated change which drives share price movement.

Recent research published by Rockefeller Asset Management (RAM)1, found that the market tends to value ESG leaders too highly while undervaluing companies that are in the process of improving their ESG footprint. RAM focused on the US all-cap equities from 2010 – 2020 and found that the top quintile ESG improvers outperformed bottom quintile decliners by 3.8% annualized.

The research indicates that it may be better to ‘travel’ than ‘arrive’ when it comes to ESG investing, and by doing so, reducing the valuation risk associated with integrating ESG factors in your portfolio.

Share prices rises are driven by improving ESG performance

Companies that treat their employees better reduce staff turnover costs, those that improve their supply chain oversight reduce their brand risk, and those that upgrade their corporate governance frameworks can deliver superior shareholder returns.

Companies that treat their employees better reduce staff turnover costs, those that improve their supply chain oversight reduce their brand risk, and those that upgrade their corporate governance frameworks can deliver superior shareholder returns.

Active equity investors can identify these opportunities through fundamental research and by engaging with companies that are accelerating ESG improvements before they are reflected in ESG scores and valuations. Improving ESG practices have the potential to increase brand value, enhance customer and employee loyalty, reduce costs (including the cost of capital), and create long-term competitive advantages.

The Pengana Axiom International Ethical Fund seeks to own companies that are undergoing positive changes which are not yet recognised in valuation levels. ESG factors, when considered along with other factors, can be a strong source of alpha generation and provide insight into management quality. Axiom has found that companies which properly manage these critical risks and become investable to a wider universe of investors can outperform the market.

ETHICAL INVESTING IN PRACTICE

Relevant ESG factors vary from one business to another, reflecting different environmental risks, customer needs, regulation, supply chains, etc. While some will impact all business models, the Axiom Fund avoids applying a ‘one size fits all’ framework, and instead focuses on the specific ESG factors that may impact a particular business or industry.

Decarbonisation is providing opportunities in electric vehicle (EV) production. Tesla is the world’s largest EV manufacturer, having grown rapidly, delivering exceptional returns for shareholders. It also makes electric trucks, battery storage and solar panels. EV adoption is also helping component makers such as TE Connectivity and STMicroelectronics grow earnings.

Food manufacturer Nestle has reduced its sugar content and published targets for healthier foods following engagement with Axiom. It is targeting 95% of its packaging to be recycled by 2025. Nestle uses 84% less water in production than its peers and promotes regenerative agriculture in emerging countries where farmers survive on thin margins. It recently invested in a solar project which will help power its US factories, reducing its energy bills, a key input cost.

Technology consultancy Gartner has improved its business ethics through better oversight, anti-bribery audits, industry-leading data security measures and board independence. Axiom engaged with Gartner regarding board longevity and gender diversity; it subsequently appointed a new female board member, Diana S. Ferguson on 29 July 2021. Progress made on business ethics, board tenure and diversity led MSCI to upgrade its ESG rating, making the company investable to a wider range of investors.

John Deere is a long-established tractor brand whose focus on sustainability aligns well with its customers and shareholders. Its herbicide applicator maximises crop productivity through robots identifying and squirting unwanted plants, which saves spraying entire fields with environmentally unfriendly pesticides. The company now also produces zero-emission electric agricultural vehicles.

- Rockefeller Capital Management, 29 September 2020, ‘ESG Improvers: An Alpha Enhancing Factor’