Environmental Policies vs. Economic Realities: Unravelling the Conundrum Amid a Cost of Living Crisis

The recent heat wave sweeping across the globe serves as a stark reminder of the urgency of combating climate change. Coincidentally, in recent weeks there have also been efforts to resist or water-down environmental policies aimed at tackling climate change and other environmental issues. As an impact-driven asset management firm, we find these developments concerning. Delaying action will increase the overall cost of tackling climate change. We urge policymakers to take a long-term and holistic approach in formulating sustainable policies to tackle these critical issues.

Recent pushbacks in environmental policies

The expansion of the Ultra Low Emission Zone (ULEZ) in Greater London is one policy that has faced significant pushback. Criticism of the scheme includes limitations caused by vehicle supply chain issues, rising vehicle prices and the cost-of-living crisis. Similar delays have been observed in other cities like Manchester and Liverpool, where plans for clean air zones were postponed. Internationally, New Jersey’s legal action against New York’s congestion charge proposal for parts of Manhattan highlights the global nature of this challenge.1

Furthermore, the UK government is planning to delay the deadline for landlords in England and Wales to meet mandatory efficiency standards for private rental properties.2 It is also set to postpone the extended producer responsibility for packaging (EPR) scheme, originally due to be effective in 2014.3 The scheme aims to shift the cost of managing packaging waste from taxpayers to businesses. Unsurprisingly, the UK government saw huge pressure from food producers and retailers, warning that the scheme will increase food and drink prices.

In Europe, a nature restoration law faced significant challenges but was ultimately preserved through the efforts of the European Parliament, albeit in a heavily watered-down form.4 Originally intended to restore damaged ecosystems and promote biodiversity across the EU, the law encountered opposition from various stakeholders. Critics argued that the legislation could adversely affect food production and jeopardise the livelihoods of farmers and fishers. All these examples highlight the complexities in balancing environmental goals with economic realities.

The rise of populism and short-termism

The rise of populism has led politicians to avoid short-term pain in order to secure votes. The UK Prime Minister Rishi Sunak’s recent threat to delay or even abandon environmental policies that add costs to consumers exemplifies this short-term mentality.5 This wavering political environment may deter investors from engaging in sustainability initiatives given the uncertainty surrounding environmental policies.

Many environmental policies, such as carbon taxes, sustainable fishing regulations, and bans on single-use plastics, encounter resistance due to perceived short-term economic burdens. Unfortunately, initial spending on these policies is often regarded as an expense rather than an investment, overshadowing their immense long-term benefits.

The expansion of ULEZ in Greater London serves as a perfect example. While estimated to cost drivers £913 million annually, the benefits of reduced air pollution and improved public health far exceed these costs.6 9,400 premature deaths are attributed to poor air quality in London with a cost of between £1.4 and £3.7 billion a year to the health service.7 Addressing vulnerable communities affected by these policies through targeted support is crucial for a successful and equitable transition.

Implications for portfolio companies

At WHEB, we are committed to investing in companies driving the transition to a sustainable world. While some portfolio companies may encounter short-term policy challenges, we believe in the long-term viability of their offerings.

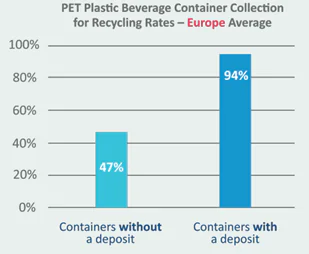

For instance, Tomra, a leading manufacturer of reverse vending machines for deposit return systems (DRSs), often encounters policy challenges. Retailers and drinks suppliers oppose the implementation of DRSs due to short-term operational challenges. Nevertheless, the positive impact of DRSs on recycling has been widely proven across many countries.

Source: Tomra

Source: Tomra

Diversified investment approach

WHEB’s diversified portfolio mitigates the impact of sustainability policy fluctuations. Many of our portfolio companies are driven by attractive value propositions. Companies like Ansys, a leader in multi-physics engineering simulation software, thrive as their growth is driven by technology adoption and efficiency improvement. Ansys’ software accelerates product time to market, improves resource efficiency and optimises product quality and safety.

Moreover, some of our companies are dedicated to addressing growing social needs and are less exposed to policy risks. For example, ICON provides outsourced clinical research services to the pharmaceutical and biotechnology companies. Its services help accelerate the development of drugs and medical devices that save lives and improve the quality of life.

The call for long-term and holistic policies

Environmental policies may pose short-term challenges, but their long-term benefits almost always outweigh the initial challenges. To ensure their effectiveness, rigorous impact assessments should be conducted to evaluate the potential benefits and drawbacks of policies with targeted support provided to affected communities .

Throughout history, numerous policy examples that were once highly controversial have now become widely accepted. Policies such as banning smoking in public places, implementing congestion charges, enforcing mandatory seat belt laws and phasing out lead in petrol. They have demonstrated significant contributions to better public health, reduced ecological damage, increased resilience to climate change, and improved quality of life for future generations.

As we navigate the path towards a sustainable future, there will inevitably be challenges along the way. The implementation of ULEZ in Central London is a compelling case in point. Despite the controversy it faced at the time, ULEZ has proven its remarkable achievements. Notably, it has successfully reduced toxic air pollution by almost half in central London.8 The number of more polluting cars has dropped by 60% since the inner London expansion in October 2021.9 The ULEZ policy’s success not only showcases the potential for transformative change in sustainability and public health but also reinforces the importance of staying committed to policies that may face initial resistance.

1 https://www.politico.com/newsletters/weekly-new-york-new-jersey-energy/2023/07/24/murphy-sues-over-congestion-pricing-00107745

2 https://www.ft.com/content/f1857432-85ae-4289-9ee6-087a205c9bbf

3 https://www.ft.com/content/c7b38af4-e6bb-44a8-802b-10622e44c649

4 https://www.lemonde.fr/en/environment/article/2023/07/13/nature-restoration-law-saved-by-european-parliament-vote-but-in-heavily-watered-down-version_6051991_114.html

5 https://www.bloomberg.com/news/articles/2023-07-24/sunak-warns-uk-climate-goals-must-not-become-hassle-for-voters?srnd=premium

6 https://www.london.gov.uk/programmes-strategies/environment-and-climate-change/pollution-and-air-quality/ultra-low-emission-zone-ulez-london/ulez-frequently-asked-questions/how-many-londoners-will-be-affected-ulez-expansion

7 https://www.londoncouncils.gov.uk/node/33227

8 https://www.london.gov.uk/new-report-reveals-transformational-impact-expanded-ultra-low-emission-zone-so-far

9 Ibid