2022 carbon commitments review and 2023 goals

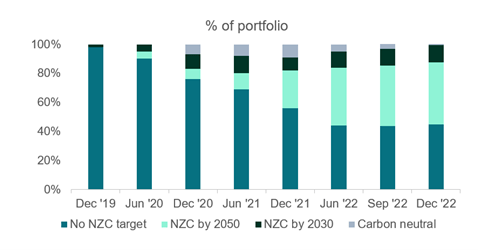

Back in 2020 WHEB committed to ensuring that, by 2025, 50% of our portfolio would have set a net-zero carbon (“NZC”) target for 2050 or earlier. By 2030, the ambition was that 100% of the portfolio would have such a commitment. At that point, in June 2020, only 10% of the portfolio had a NZC target and 50% by 2025 seemed like a challenging ambition. However, now at the end of 2022, we see that 54% of WHEB’s portfolio companies have announced a NZC commitment, with a huge 90% of those companies with targets already approved, or committed to having them approved, by the Science Based Targets initiative.

Focusing on major emitters

We are delighted with the progress our portfolio companies have made and have now set our sights higher. One of the features of our portfolios is that a large majority of scope 1 and 2 greenhouse gas (GHG) emissions come from a small number of companies. In fact, the top 5 emitting companies in our portfolio account for over 75% of the entire portfolio’s emissions. In contrast, the bottom 5 account for less than 0.5%. In order to deliver significant emission reductions, we need these high emitting companies to set NZC targets and reduce their emissions.

In 2023, therefore we are setting our focus and our new targets will focus on the proportion of ‘financed’ emissions1 coming from the portfolio that are covered by targets, rather than simply the proportion of the companies in the portfolio that have targets.2

Setting more ambitious targets

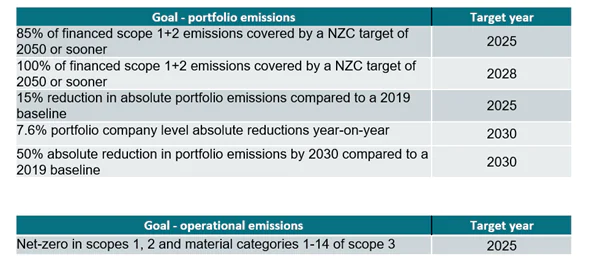

Based on this new metric, the percentage of our financed emissions currently covered by a NZC target sits at 74%.3 In addition to changing the parameter, we will also be increasing the aim of our target, with 85% of the financed emissions in the portfolio to be covered by a NZC target by 2025, and 100% by 2028 rather than the original aim for 100% by 2030.

Interrogating the credibility of NZC targets

It would be naïve of us to simply accept the NZC targets of our portfolio companies without undertaking some due diligence on validity of the claims. This year WHEB will be assessing the credibility of these NZC targets based on several metrics. These will include, among others, the need for companies to disclose and set targets for all material emission scopes, have their targets validated by a third-party, and ensure there is board level responsibility for climate action. These metrics will inform where we need to direct our engagement efforts, focusing first on the highest emitters without NZC targets, and then looking at those companies that do not, in our opinion, have credible NZC targets.

Measuring real-world emission reductions

We pride ourselves on our transparency at WHEB, and for 2022 we will be reporting on the NZC projects mentioned above, as well as the annual reductions in our financed emissions. We will differentiate between portfolio emission reductions achieved through divestment of high emitting companies, and actual real-world year-on-year reductions accomplished by those portfolio companies still held in the portfolio. By 2025 we are hoping to achieve a 15% reduction in the absolute portfolio emissions when compared to a 2019 baseline. Even more ambitious is our target for portfolio companies to reduce their absolute carbon emissions by 7.6% each year to 2030. This level of reduction is what is needed to limit global warming to the 1.5°C goal of the Paris Agreement.4

Operational emissions

For WHEB’s operational emissions, we remain committed to net-zero carbon emissions by 2025 for scopes 1 and 2 and the relevant and material categories 1-14 of scope 3. The legacy impact of COVID has supported the reduction in our business travel, as it did for most companies, however this picked up slightly in 2022 as lockdowns across the world eased. Train travel is the chosen transport mode wherever possible for WHEB and always for journeys that take less than 6 hours on the train. Indeed, one dedicated member of the team spent 20 hours travelling back from Copenhagen to London via several trains.5

WHEB has committed to having both our operational and portfolio targets validated by the SBTi during 2023.

The vexed question of carbon offsets

The offsetting of carbon emissions is a tricky subject to navigate and there doesn’t yet appear to be an established best practice approach. At one end of the scale, there are “avoided emissions” projects such as fuel efficient cookstoves. Here clean cookstoves are provided to households in less developed countries, leading to fewer CO2e emissions as well as improved air quality and lower costs for the household. The cookstoves provide benefits not only to the atmosphere, but also for the owners. However, it is difficult to prove that the emissions are permanently avoided.

While of course ‘avoided’ carbon projects are needed, carbon removal is inevitably going to be a critical technology to limit global warming to 1.5°C. Carbon removal projects range from nature-based solutions that are well established and extraordinarily cheap in some cases, to technology-based projects still in development, and requiring huge amounts of funding with limited capacity currently. Nature-based solutions, such as tree planting, naturally absorb carbon from the atmosphere as well as contributing towards a healthy eco-system. To be effective at storing carbon they need to remain growing for a significant amount of time, which cannot be guaranteed over the long-term.

Technology-based solutions such as Direct Air Capture (DAC) do appear to be permanent, and it is significantly easier to quantify how much carbon has been stored. The main challenges with technology-based solutions are cost and scale. According to the IEA, as of September 2022 there were 18 DAC plants worldwide, capturing only 10,000 tCO2 per year.6 It is clear that we cannot rely on one type of project to remove the amount of carbon required to meet the goals of the Paris Agreement, we will need a combination of all carbon offset solutions.

WHEB’s approach will be to create a portfolio of avoided carbon projects, including both nature- and technology-based carbon removal projects, all of which will be verified to Gold or VCS standards.7 We will only offset those residual emissions that cannot be reduced further or eliminated. By supporting a diverse range of initiatives through this portfolio-based approach, we can attempt to maximise both the environmental and social benefits associated with the projects.

1 ‘Financed emissions’ refer to the emissions associated with WHEB’s specific level of investment in the investee company.

2 The new financed emissions target will be more volatile as it depends on the enterprise value of the portfolio company, as well as the value of our holding in the company which both change constantly. Consequently, we use a rolling 12-month average of the financed emissions data point to provide a clearer trend.

3 Based on the FP WHEB Sustainability Fund.

4 https://www.unep.org/news-and-stories/press-release/cut-global-emissions-76-percent-every-year-next-decade-meet-15degc

5 https://www.whebgroup.com/our-thoughts/business-travel-without-the-carbon-footprint-one-travellers-experience

6 https://www.iea.org/reports/direct-air-capture

7 The Gold Standard and Verified Carbon Standard (VCS) are the world’s most widely used greenhouse gas (GHG) crediting program.