Pengana WHEB Sustainable Investing Report Shows Positive Impact of Investments

Monday, 3 June 2019: Pengana Capital Group Limited (ASX: PCG) today released the latest Pengana WHEB Sustainable Investing Impact Report ‘Prosperity with Purpose’, which quantifies the positive impact associated with investing in companies that are enabling and benefitting from the transition to a low carbon and more sustainable economy.

WHEB Asset Management (‘WHEB’) (UK), a boutique investment house focused exclusively on sustainable investing, is at the forefront of sustainable and impact investing globally, and plays an active role in many of the organisations leading the thinking in this investment space.

WHEB is the investment manager of the Pengana WHEB Sustainable Impact Fund (the ‘Fund’) and has run the same strategy in the UK for more than 13 years. The Fund holds 50-70 stocks, with a typical holding period of four to seven years. It only invests in companies that produce goods and services that address the challenges of sustainability, thereby generating a positive social or environmental impact.

George Latham, Managing Partner, WHEB said: “Population growth, resource scarcity, environmental degradation, and a myriad of social issues are increasingly motivating investors to examine the social and environmental impact of companies and how these businesses adapt and respond to these investor pressures.”

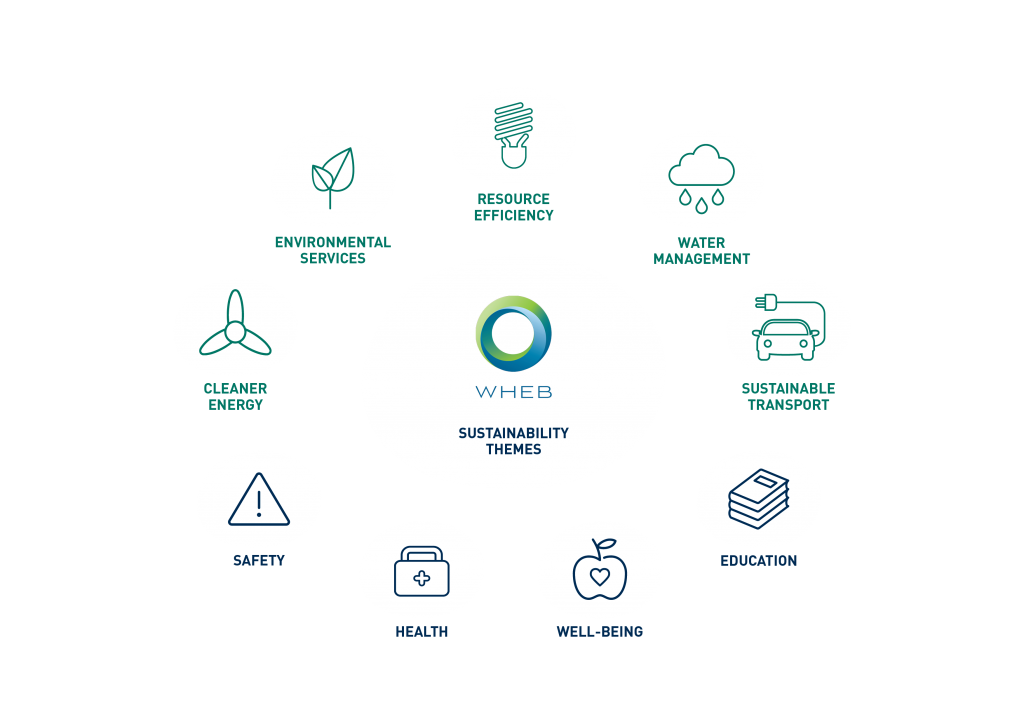

WHEB has identified critical environmental and social challenges facing the world over the next 30 years, and invests in a range of companies that provide solutions to these challenges based on nine sustainable investment themes (see below).

WHEB’s nine sustainability themes: Markets with strong long-term growth potential

WHEB is committed to measuring and reporting the impact of its investments and the Impact Calculator enables investors to track the positive impact associated with their investment in the Fund.

For example, $100,000 invested in the Fund through 2018 helped avoid 44 tonnes of CO2 emissions, treated 553,000 litres of waste water, recycled 11 tonnes of waste materials, provided 7 days of tertiary education, and supported 6 people in receiving healthcare treatment, preventative care and/or healthy living programs.

Adam Myers, Executive Director at Pengana Capital Group said: “We have received consistent feedback from financial advisers and investors that ethical, sustainable and responsible investing is a priority to them. This trend is growing, and investors are becoming more savvy in how they assess the sustainable investment opportunities now available to them. The transparency that WHEB provide enables investors to make a tangible connection between their investments and the positive impact that investment can make”.

The ‘Prosperity with Purpose’ report and impact calculator can be accessed at pengana.com/impact.

ENDS

Media Enquiries:

Rashmi Punjabi, Honner

rashmi@honner.com.au

+61 2 8248 3734

About Pengana Capital Group

Pengana Capital Group is a listed funds management group focused on listed and unlisted equities, managing eleven active strategies in Global and Australian markets.

Pengana Capital Group believes that alignment of interest between a fund manager and its investors is crucial. Our business and our funds are structured and managed within this framework.

Headquartered in Sydney, Pengana Capital Group was founded in 2003 and also has operations in Melbourne and Brisbane. Directors and staff are significant equity owners in the company.

About WHEB Asset Management

WHEB is a positive impact investor focused on the opportunities created by the transition to a low carbon and sustainable global economy. We are well known and respected for our experience, expertise and innovation in sustainable and impact investing.

We focus on a single global equity strategy, which has been developed over the long-term and tested across market cycles. We are an owner managed partnership that is incentivised to take long-term decisions. WHEB Asset Management is a Certified B Corporation.

Please see www.whebgroup.com for more details on our investment strategy, thought leadership and market commentary.

Important Information

Pengana Capital Limited, ABN: 30 103 800 568 AFSL 226566 is the responsible entity and issuer of units in the Pengana WHEB Sustainable Impact Fund (ARSN 121 915 526) (the Fund). A product disclosure statement for the Fund (PDS) is available and can be obtained from our distribution team. A person should obtain a copy of the PDS and should consider the PDS carefully before deciding whether to acquire, or to continue to hold, or making any other decision in respect of, the units in the Fund. This report was prepared by Pengana Capital Limited and does not contain any investment recommendation or investment advice. This report has been prepared without taking account of any person’s objectives, financial situation or needs. Therefore, before acting on any information contained within this report a person should consider the appropriateness of the information, having regard to their objectives, financial situation and needs. Neither Pengana Capital Limited nor its related entities, directors or officers guarantees the performance of, or the repayment of capital or income invested in, the Fund. Past performance is not a reliable indicator of future performance, the value of investments can go up and down.