Is Co-Investing Still the Right Approach During a Market Dislocation?

View PDF Version

KEY TAKEAWAYS

- Buyout deal volume and invested dollars drastically slowed in Q2 2022, but recently we have begun to see a return in deal activity across market-leading businesses and value-oriented deals.

- History has shown that market dislocations can provide an ideal time to deploy capital to high-quality assets at attractive valuations. Periods following market downturns have also historically proven to be stronger returning vintages within private equity, especially for top quartile managers as seen following the Dot-Com Bubble and Global Financial Crisis.

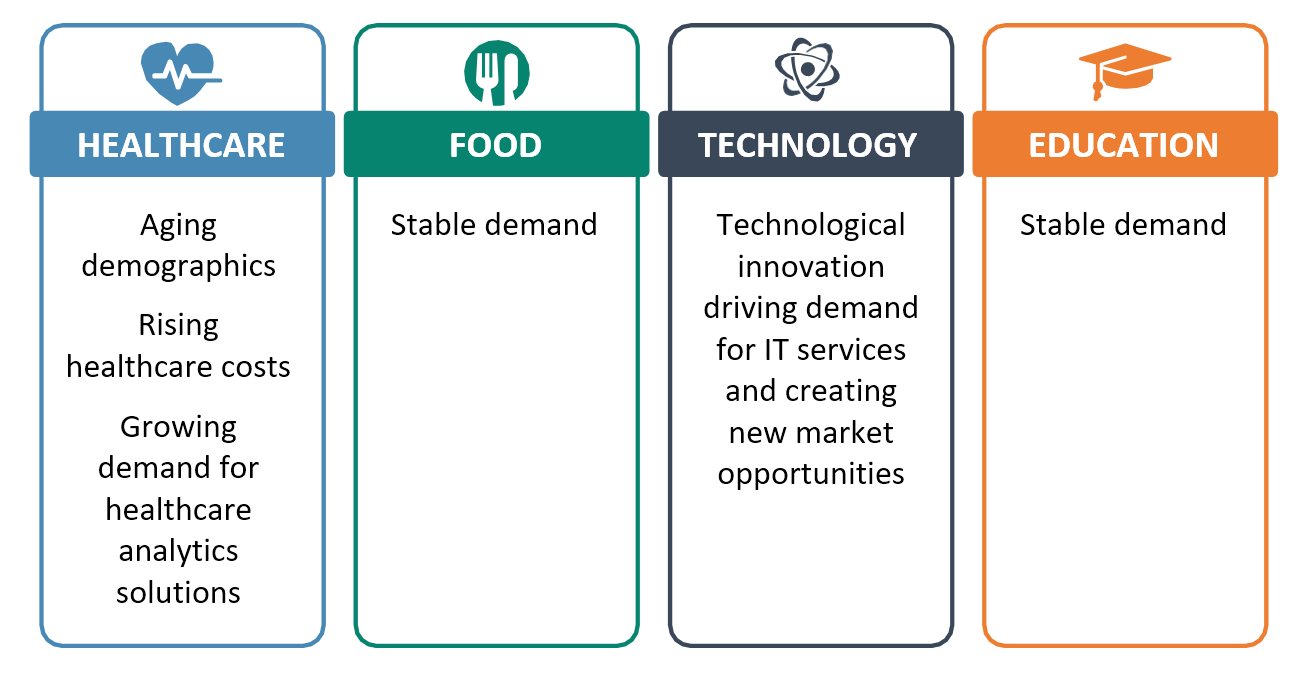

- Given the current environment, we believe investors should focus on businesses in industries benefitting from strong secular tailwinds (healthcare, food, technology, and education), companies with leading market positions, and investments where value creation is largely driven by “controllable” levers. They may want to avoid companies operating in more cyclical industries or whose customers can delay purchases, more labor-intensive businesses that are exposed to higher commodity and/or transportation costs, and companies whose business models or capital projects are more interest rate sensitive.

- Co-investing enables investors to build a well- diversified portfolio through a fee-advantaged structure and is an efficient and tactical way to access private equity opportunities in any market environment. In other words, the co-investment value proposition remains strong.

Select risks include: information risk, management risk, risks related to reliance on third parties, and risks related to the sale of investments.

In the following, we address some of our clients’ most-often asked questions regarding buyout transactions and whether or not co-investing is the right approach given the current market environment.

Q. What changes have you seen in buyout deal volume and the types of deals that are getting done over the last 6 months?

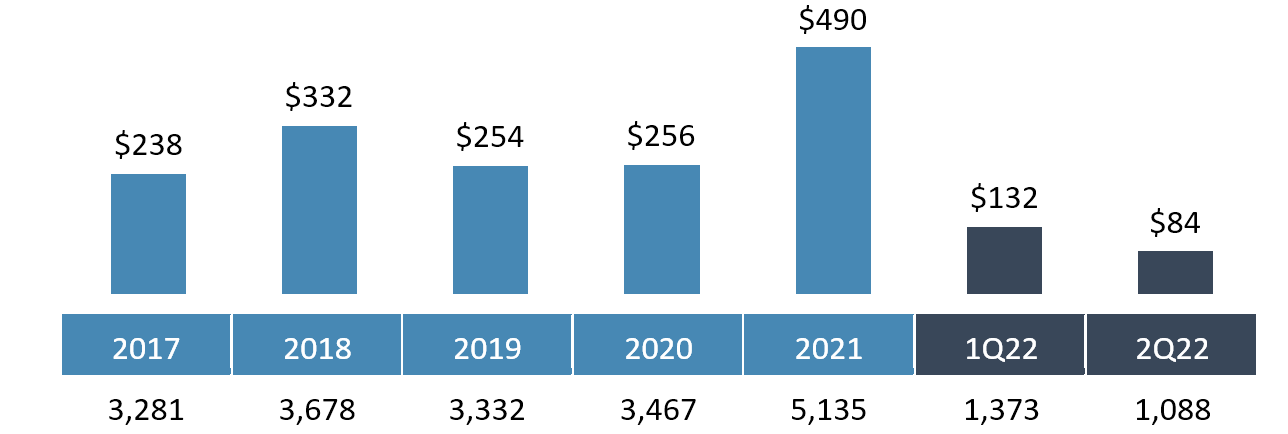

The first half of 2022 was the “tale of two quarters” in the North American buyouts market. Q1 saw robust deal activity with double-digit growth in the number of deals closed and an approximately 15% year-over-year increase in the amount invested, largely fueled by continued growth coming out of the pandemic. However, as the economy began feeling the impact of Russia’s invasion of Ukraine and widespread supply-driven inflation, deal activity paused in Q2 as markets turned and valuations recalibrated. Bid-ask spreads widened between elevated seller expectations and value-oriented buyer interest. Q2 witnessed a dramatic slowdown in the number of deals, a moderation in purchase price multiples, and an approximately 36% decline in invested dollars from Q1(1).

North American Buyout Deal Activity Declined from the Pace of 2021 and Early 2022

$ billions and # of deals

Figure 1

Source: Preqin, August 2022.

More recently, we have witnessed a return in deal activity across two general themes:

- Market-leading businesses with strong recurring revenue and/or demand characteristics less correlated to GDP growth.

- Value-oriented deals that take advantage of lower valuations and/or trough earnings. Notably, due to volatility in the public markets, fewer corporate acquirers have been participating in auctions and the IPO route to exit has dramatically slowed compared to 2021, leading to a less competitive environment for financial sponsors.

Q. Given the macro uncertainty, is now a good time to be investing in buyout deals?

Yes, we believe that market dislocations often provide interesting investment opportunities to acquire high-quality assets at attractive valuations. Periods that follow historical market downturns, including the Dot-Com Bubble and Global Financial Crisis, have proven to be stronger returning vintages within private equity, especially for top quartile managers. According to Burgiss market data, North American

top quartile GPs generated 26.7% and 23.9% IRRs in 2001 and 2002, respectively, which far exceeded the ensuing bull market years from 2003-2008. Similarly, the next high performing vintage year was 2009 at 24.9% – the period during and shortly after the Global Financial Crisis.

Top Quartile GPs Perform Well Following Market Downturns

Figure 2

Source: BURGISS: Data as of December 31, 2021; downloaded May 3, 2022. Returns are stated in USD.

However, it is difficult for investors to “time the market” in private equity, especially given the time periods between commitment to a sponsor’s fund and when the money gets invested, and the longer- term holding periods of underlying companies. Therefore, a consistent pacing strategy with exposure across different vintage years has proven to be an effective strategy to provide investors with attractive risk-adjusted returns over time, versus trying to decide which vintage year may be better than others.

Q. What deal qualities are important to select or avoid given the current environment?

High-quality businesses in industries that have historically benefitted from strong secular tailwinds could help insulate investors from potential economic softness, including sectors like healthcare, food, technology, and education.

Secular Tailwinds

Companies with leading market positions can use their scale to manage through macro gyrations, giving them a natural competitive advantage. Additionally, investments where value creation is largely driven by “controllable” levers can be attractive since they are typically less reliant on external factors for return generation. These internally driven value creation levers can include cost rationalization, process improvement, geographic and/or product expansion, professionalization opportunities, as well as accretive M&A, and are often found in take-private transactions, corporate carve-outs, and family- owned businesses. In all scenarios, utilizing prudent levels of leverage can be paramount in providing businesses with financial flexibility to navigate any economic uncertainty.

By contrast, companies operating in more cyclical industries or whose customers can delay purchases could face greater demand risk, putting downward pressure on sales. From a supply standpoint, investors may want to avoid more labor-intensive businesses and those that are exposed to higher commodity and/or transportation costs given current market constraints. Lastly, companies with business models or capital projects that are more interest rate sensitive may face pressure given the Fed’s current tightening monetary policy.

Q. How should investors think about portfolio construction in today’s market?

Co-investing alongside top performing managers is an efficient and tactical way to access private equity opportunities in any market environment. As a co-investor, one can construct a diversified portfolio by choosing sectors and strategies that best suit current market conditions over time, as compared to traditional private equity managers who are beholden to one sector or strategy focus. That being said, co-investors can still benefit from the advantages of focused private equity strategies by partnering with sector specialists whose reputation, resources, and experience in specific industries provide superior access to unique opportunities. Co-investors can further leverage a sponsor’s expertise to execute on value creation strategies that have been historically proven to be effective across market cycles. Finally, private equity co-investing enables investors to build a well-diversified portfolio through a fee- advantaged structure to offer potentially superior net returns.

Learn more about why an increasingly volatile market environment can favor middle market co-investments.

Conclusion

The years following an economic downturn have proven to be some of the best performing private equity vintages as demonstrated after the Global Financial Crisis and Dot-Com Bubble. By co-investing alongside experienced sponsors and focusing on deals in industries that have historically benefited from strong secular tailwinds, companies with leading market positions, and investments where value creation is largely driven by “controllable” levers, private equity investors can be well positioned to take advantage of the opportunity set arising from current market volatility.

Important Disclosures

For illustrative and discussion purposes only.

No assurance can be given that any investment will achieve its objectives or avoid losses. Past performance is not necessarily indicative of future results.

The information and opinions expressed are as of the date set forth therein and may not be updated to reflect new information.

Investments in alternatives are speculative and involve substantial risk, including strategy risks, manager risks, market risks, and structural/operational risks, and may result in the possible loss of your entire investment. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations, or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions, and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided by parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.

Data sources:

Certain information, including benchmarks, is obtained from The Burgiss Group (“Burgiss”), an independent subscription-based data provider, which calculates and publishes quarterly performance information from cash flows and valuations collected from of a sample of private equity firms worldwide. When applicable, the performance of GCM Grosvenor’s private equity, real estate, and infrastructure underlying investments are compared to that of its peers by asset type, geography and vintage year as of the applicable valuation date. GCM Grosvenor’s Asset Class and Geography definitions may differ from those used by Burgiss. GCM Grosvenor has used its best efforts to match its Asset Class, Geography, and strategy definitions with the appropriate Burgiss data but material differences may exist. Benchmarks for certain investment types may not be available. GCM Grosvenor uploads data into its system one-time each quarter; however, the data service may continue to update its information thereafter. Therefore, information in GCM Grosvenor’s system may not always agree with the most current information available from the data service. Additional information is available upon request.

1 Source: Preqin 2022