Private credit an option for investors, even as recession looms

By Millie Muroi – The Sydney Morning Herald – original article

Australian investors are set to have greater access to global exposure in lending to corporates after fund manager Pengana Capital Group and investment company Washington H Soul Pattinson arrived at a joint venture involving private credit, even amid the prospect of a recession and as banks tighten their lending.

On Wednesday, Pengana announced it would offer investors “unprecedented access” to global private credit investments in the next few months, having built a portfolio over the past year using $200 million of capital provided by WHSP.

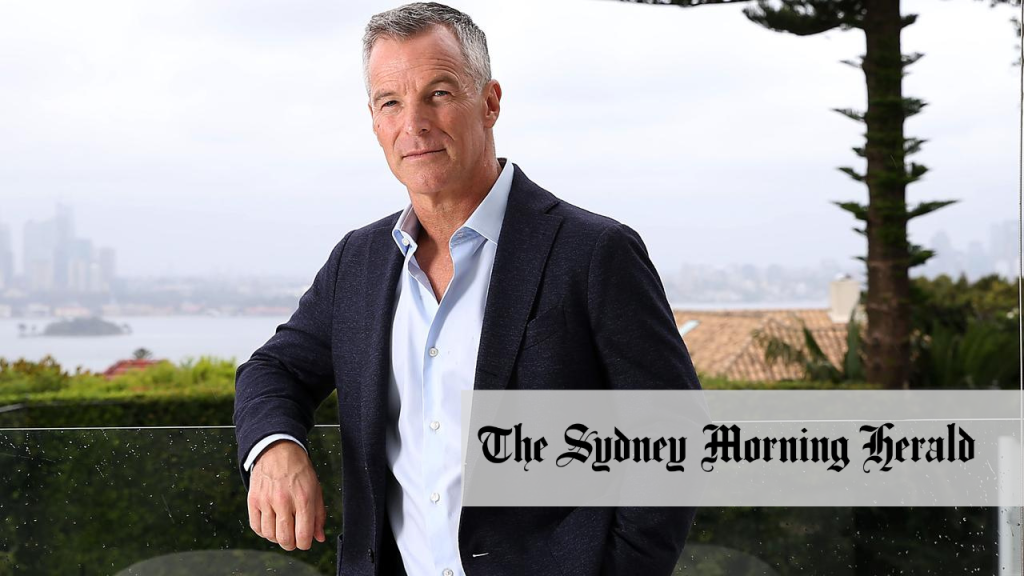

Pengana chief executive Russel Pillemer said there was a severe lack of exposure to global private lending in Australia despite it being a rapidly growing market internationally.

“If you’re an Australian individual investor, or even a family office, you can’t get access to top-tier, global private credit; it just doesn’t exist,” Pillemer said.

While private credit accounted for about 12 percent of lending globally last year, it made up just 2 percent of local lending, according to the Australian Investment Council.

Pengana is not the first financial company to jump into the private credit space, with Regal Funds Management launching a private credit opportunities fund in October and Metrics Credit Partners managing $14 billion in the market.

‘Banks have been contracting in terms of what they’re willing to lend and who they’re willing to lend to.’ – Russel Pillemer, Pengana chief

But Pillemer said Australian banks dominated lending locally, and that overseas private credit markets – where demand more dramatically exceeds supply – were more enticing, especially following the collapse of Silicon Valley Bank and the pullback by global banks.

“Banks have been contracting in terms of what they’re willing to lend and who they’re willing to lend to,” Pillemer said. By contrast, he said private credit managers could be more agile, offering risk-based pricing – where the lender charges a borrower higher interest rates to compensate for the higher risk associated with unusual loans or other factors.

“Because there’s such strong demand for this capital, the spreads – or returns – between what the banks can lend out and what private credit managers can get, is huge,” Pillemer said.

While it can carry higher risks than assets such as bonds, Pillemer said private credit could help diversify portfolios because it had a low correlation with listed equities and fixed income.

Domestically, private credit is concentrated in the property space, but Pillemer said Pengana would focus on other sectors and look globally.

“We have very little, if any, property exposure,” he said. “We invest with various managers who operate in different sectors, and it could be anywhere from retail to financial services. Most of the exposure is in the US, but there’s also a fair amount in Europe, with a lot of industrial companies.”

Pillemer said investors in Pengana’s private credit vehicles would get exposure to the fund’s entire portfolio, comprising about 400 exposures.

Despite the prospect of a recession, Pillemer said he was confident in the portfolio’s ability to deliver returns because it was put together with the recessionary risk in mind.

“I think we’ve got a real advantage because we’ve been investing in the portfolio for the last few months, knowing that there’s a strong possibility of a recession,” he said. “We’ve chosen businesses to lend to that have predictable and stable cash flows, rather than cyclical businesses, whereas if you made loans three or four years ago, or even just after COVID, you might have been overly bullish in evaluating companies.”