Listed private equity – A superior pe investment

LISTED PRIVATE EQUITY; PRIVATE EQUITY REIMAGINED

In Part 2 of our 4-part series Listed Private Equity: Private Equity Reimagined, Consulting Economist Steven Milch explores the emergence of Listed Private Equity. By enabling private equity investment via securities traded on major stock exchanges, Listed Private Equity addresses aspects of private equity that have previously deterred investors. Moreover, the literature and data support the private equity return premium also accruing in Listed Private Equity returns

THE EVOLUTION OF PRIVATE EQUITY

Although private equity dates back to 1901, when J.P Morgan purchased Carnegie Steel Co[1], it is still a young and evolving asset class. Among the ‘recent’ PE developments has been the emergence of Listed Private Equity (LPE) – although even LPE has been a feature since 1976, when Electra Private Equity listed on the London Stock Exchange[2].

Given the advantages, which we discuss below, this latest phase in the development of PE has been accompanied by substantial growth. Global PE assets under management now exceed $US3 trillion[3], with the market capitalisation of LPE now in excess of $US140 billion[4].

Introducing Listed Private Equity

In response to the superior returns offered by PE, while at the same time addressing aspects of the asset class that have previously deterred investors, Listed Private Equity enables private equity investment via publicly traded securities listed on major stock exchanges. Accordingly, LPE overcomes several of the challenges of ‘traditional’ PE, as outlined below.

- The listed structure allows ready access to a ‘permanent’ portfolio of underlying PE assets (since the proceeds from investments can be recycled into new transactions) without liquidity, size or timing constraints.

- The flexibility of LPE means that exposures can be adjusted dynamically in response to investor preferences, market conditions and the investment exposures of the underlying portfolio.

- LPE can provide diversification of PE exposures across a range of maturities, styles, sectors and geographies with less ‘cash drag’ than traditional PE (whereby performance is curbed by capital remaining uninvested early – and often for years – in the investment term of an unlisted fund).

- Transparency is significantly enhanced with LPE, not only by the availability of daily market prices but also due to the strict disclosure, reporting and governance requirements associated with listing on a regulated exchange.

- Transaction and ‘search’ costs – those costs associated with identifying a suitable investment – are significantly lower for LPE[5] when compared with traditional PE.

- LPE securities are generally able to provide more predictable cash flows as listed trusts typically pay regular distributions[6].

Given these advantages, a discussion of LPE returns is warranted. Specifically, we address two issues. First is whether the PE return premium over equities is also evident in LPE. Second, in Part 3 of our series, we consider the relationship between the underlying valuations of LPE securities (or their Net Asset Values) and their market prices.

LPE performance – do the advantages come at a cost?

In Part 1, we identified the complexities of private equity investing, namely illiquidity, inflexible timing, lack of transparency, the absence of clear price discovery and the reduced separation between ownership and control. We also identified the ‘PE premium’ which can be regarded as an investor’s ‘compensation’ for bearing these characteristics. We concluded, based on the data, that this premium is close to 3% per annum above the return on global shares.

Having identified LPE as an investment vehicle which provides PE exposure yet addresses a number of its challenges, we now investigate whether the PE premium also accrues to LPE. From one perspective, perhaps a lower premium could be expected as the theory would suggest less need for investors to be compensated for factors such as illiquidity.

Alternatively, LPE may retain the PE premium, given that a) the ‘listed’ or ‘liquid’ feature of Listed Private Equity has no impact on the valuations of the underlying private equity assets, and b) the attractiveness of the asset class may lead to the prices (and returns) of listed PE securities being supported by investor demand.

The literature certainly finds evidence of the PE premium in LPE. For example, Bergmann et al (2010) conclude, based on performances from 1994 to 2008, that “there are no significant differences in the behavior [sic] of listed and unlisted private equity vehicles during the investigated time span” [7].

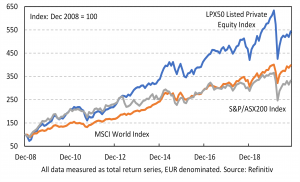

CHART 1: SUPERIOR RISK-ADJUSTED RETURNS

Updating the Bergmann data to 2020 reaffirms this conclusion. From December 2008 to June 2020 the LPX50 Listed Private Equity index posted an annual average return of 15.5%, compared to 12.2% for the MSCI World equity index[8] and 10.6% for the S&P/ASX200 index of Australian shares.

These performances, which are shown in Chart 1, equate to a 3.3% LPE premium over global shares and a 4.9% premium over Australian shares, thereby exceeding the 2.9% PE premium identified in Part 1 of this series.

While LPE retains the superior returns of traditional private equity, features such as liquidity and daily pricing may be accompanied by higher volatility than traditional private equity. Furthermore, LPE’s closer correlation to broad market equities reduces to some extent the diversification that traditional private equity can bring to a portfolio.

To conclude, Listed Private Equity, by overcoming the obstacles associated with traditional PE, brings several advantages for the investor. These advantages can be harnessed without a performance cost as the return premium for Listed Private Equity is comparable to that for traditional PE.

In Part 3 of our series Listed Private Equity – Capitalising the Premium we examine the relationship between price and Net Asset Value for Listed Private Equity securities.

REFERENCES

BCA Research, “Private Equity: Have We Reached The Top?“, 2018.

Bergmann, B., Christophers, H., Huss, M. and Zimmerman, H., “Listed Private Equity“ in Cumming, D.J. ed, Private Equity: Fund Types, Risk, Return and Regulation, 2010, Chapter 4, pp. 53-70.

Huss, M. and Zimmerman, H., “Listed Private Equity: A Genuine Alternative for an Alternative Asset Class” in The Oxford Handbook of Private Equity, 2012.

LPX Group, “LPX Composite TR Index Factsheet“, July 2020, <https://www.lpx-group.com/lpx_indexing/index-information/index-factsheets/

S&P Dow Jones Indices, “Talking Points – The S&P Listed Private Equity Index”, 2019, < https://www.spglobal.com/spdji/en/indices/equity/sp-listed-private-equity-index/#overview>.

ABOUT THE AUTHOR

Steven Milch

With a career as an economist and institutional investor spanning over 30 years Steven Milch (M Ec, B Comm Hons) has accumulated extensive financial market experience and a unique breadth of knowledge.

Steven currently holds postgraduate teaching positions with the University of New South Wales and Kaplan Business School. He manages assets in the not-for-profit sector and acts as Pengana Capital’s Consulting Economist.

Previously, Steven was Chief Economist and Head of Investments for the Suncorp Group. In this capacity, he led the Group’s Investment Research and Economics function and supervised the management of $21 billion of investment portfolios, focussing on asset allocation, manager selection and responsible investment initiatives.

Before joining Suncorp, Steven held the position of Chief Economist, St.George Bank. Steven has also worked at the Reserve Bank of Australia and has owned a successful investment advisory business. Steven is an investor in the Pengana Private Equity Trust (ARSN 630 923 643) (“PE1”).

IMPORTANT INFORMATION

Pengana Investment Management Limited (ABN 69 063 081 612, AFSL 219 462) (“Pengana”) is the issuer of units in PE1. A Product Disclosure Statement for PE1 (“PDS”) is available and can be obtained by contacting Pengana on (02) 8524 9900 or from www.pengana.com. A person who is considering investing in PE1 should obtain a copy of the PDS and should consider the PDS carefully and consult with their financial adviser to determine whether PE1 is appropriate for them before deciding whether to invest in, or to continue to hold, units in PE1. This report was prepared by Pengana and does not contain any investment recommendation or investment advice. None of Pengana, Grosvenor Capital Management, L.P., nor any of their related entities, directors, partners or officers guarantees the performance of, or the repayment of capital, or income invested in PE1. An investment in PE1 is subject to investment risk including a possible delay in repayment and loss of income and principal invested. Past performance is not a reliable indicator of future performance, the value of investments can go up and down.

[1] BCA Research (2018).

[2] Bergmann, Christophers, Huss and Zimmerman (2010).

[3] BCA Research (2018).

[4] LPX Group (2020).

[5] Huss and Zimmerman (2012).

[6] S&P Dow Jones Indices (2019).

[7] Bergmann, Christophers, Huss and Zimmerman (2010) p.68 investigating the period 1994 to 2008. Listed Private Equity returns provided by the LPX50 TR index.

[8] Sources: LPX Group and Refinitiv. Both series measured in EUR.