Identifying winners as technology changes the world

The Fund currently holds a 28% weighting in the technology sector, with significant further investments in dynamically growing tech-orientated companies. This currently looks like a great place for investors as technological innovation gives rise to big shifts in spending across the economy.

New products which address unmet needs can deliver quantum leaps in the profitability of companies which align early to these trends. The positive impact on earnings can dwarf any negative effect of a dip in the business cycle as interest rates slow the global economy.

“technological innovation gives rise to big

shifts in spending across the economy”

Axiom’s investment process identifies companies exposed to secular growth trends in technology which can compound earnings, regardless of weakness in consumer spending or interest rates.

PROGRESS NEVER SLEEPS

Technology brings permanent change to households and businesses. It is relatively easy to identify in hindsight technological changes which made our lives easier, reduced costs and created fantastic new businesses. We can think of steam turbines, electricity and telephones, or more recently, personal computers, the internet and smart phones.

The Pengana Axiom International Ethical Fund is focussed on the technological trends driving future earnings growth. The Fund holds positions in innovative companies that are aligning their business models to capture market leading positions as technology evolves.

ARTIFICIAL INTELLIGENCE (“AI”)

AI is expected to be the transformative technology of the decade, revolutionising the way we work. Nvidia has been described as the ‘heart and lungs of AI.’ It is the world’s leading designer of graphics processing unit (GPU) semiconductors that drive datacentres and video games, with a 95% market share. Its current US$14 billion of annual earnings are expected to grow by 40% each year through to 2027 as AI is rapidly adopted.

CLOUD COMPUTING

Cloud computing – the delivery of services such as data storage, servers and software online – is being enhanced by the implementation of AI. Microsoft’s public cloud service Azure is a market leader, currently generating US$56 billion in annual revenue and growing at 25% annually. The company is already seeing earnings growth from its partnership with ChatGPT developer OpenAI.

ELECTRIC VEHICLES

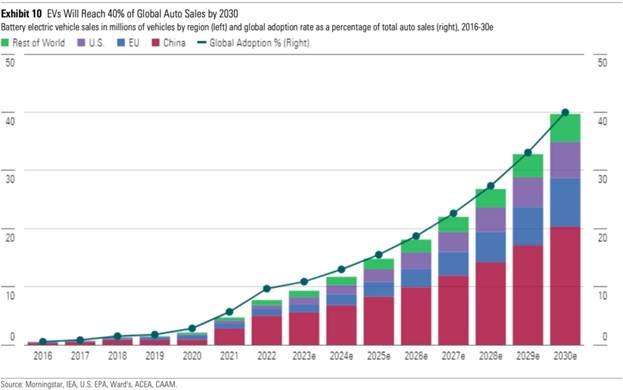

Technology, costs, regulation, and consumer preference are aligning to drive EV demand, which today still accounts for just 10% of global auto sales. This is expected to increase rapidly as over 20% of vehicle sales in Europe and 30% in China last year were electric or plug-in hybrids

Growth in EV share of total global auto sales, 2016 – 2030

Tesla may lead the pack in the EV manufacturing market, but a much wider ecosystem is being built upon the electrification trend. STMicroelectronics, a world leading provider of key components in the EV market, such as power semiconductors, is seeing surging demand.

Tesla may lead the pack in the EV manufacturing market, but a much wider ecosystem is being built upon the electrification trend. STMicroelectronics, a world leading provider of key components in the EV market, such as power semiconductors, is seeing surging demand.

AUTOMATION

![]()

Labour shortages are driving the trend towards increased automation, impacting industries including manufacturing, agriculture and transport. Uber recently launched its first robotaxi service in Las Vegas. This trend aligns with the longer-term switch in urban areas away from car ownership to shared usage, in which trusted brands with established infrastructure will be well positioned.

ENTERTAINMENT

Output from the global entertainment industry is being consumed in new ways Sony has aligned to these changes, pivoting from its legacy consumer electronics business (which now accounts for less than 20% of operating profits) to delivering entertainment. Its revenue growth is now being driven by music streaming and video gaming, (which is now twice the size of the global film industry).

Sony Business Unit Revenue Growth FY21 to FY22

Source: Sony