ESG: Deconstructing returns

Since its inception almost 25 years ago, Axiom, the manager of the Pengana International Axiom Ethical Fund, has incorporated Environmental, Social, and Governance (ESG) considerations into their fundamental investment process in the same way as any other factor or information set is included. This early adoption has contributed to the long-term outperformance of the strategy.

The outperformance of ESG factors is driven by more than just fundamental quality characteristics

A common misconception is that ESG criteria are synonymous with Quality factors – they are materially different. Research conducted by MSCI has shown that companies that score well on ESG factors have outperformed companies scoring well on Quality factors, while other studies have found combining both to be a stronger predictor of long-term outperformance.

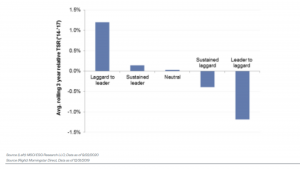

The change in ESG alignment matters more than the static ESG profile in terms of alpha generation

Axiom who are focused on identifying dynamically growing companies experiencing positive change, favour the combined approach. They have found that companies that improve their ESG characteristics, particularly those going from “Laggard to Leader” tended to outperform on a total shareholder basis, even when compared to Sustained Leaders.

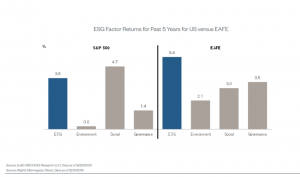

Social has started to outperform other ESG Factors over the past few years in the US

Whilst understanding the change in the ESG alignment is important, what does it mean at the different subcomponent levels ie the “E”, “S” & “G”? Over the course of the last few years and more recently in the past year. In the US, Social factors, have outperformed meaningfully relative to Governance and relative to Environmental factors.

In both cases, Environmental factors are the underperforming factor that may run contrary to people’s perception of what it means to be advancing positive change from an ESG standpoint.

The right-hand chart above displays factor returns for a composite index of Europe, Asia, and the Far East (“EAFE”) and it shows Governance is the outperformer, followed by Social and Environmental. Whilst we can all agree that Environmental improvements are critical to achieving net neutrality for carbon and the general health and wellbeing of the planet. It is becoming clear that not all ESG factors are equal when it comes to generating investment returns.

Why is Social such a persistent outperformer relative to Environmental?

People are the key assets for many structural growth businesses. Once improvement areas are identified, changes can often be quickly implemented, and results may follow quickly. Companies often enjoy “quick wins” through implementing training or mentorship programs and more progressive employment policies quickly help attract higher calibre employees. From an analyst’s perspective, this will reflect in higher social scores.

Environmental improvements on the other hand generally take much longer to implement and, in many cases, involve short-term costs associated with changing business practices. Recognising the importance of addressing anthropogenic climate change, we are increasingly seeing businesses targeting net carbon neutrality from their operations. However, these objectives are generally longer term so it is more appropriate to assess the business impact over a longer time horizon. As such, the impact will take longer to reflect in the data.

How can you track these ESG improvements? And stay ahead of the curve

Today’s investors wrestle with confusing and inconsistent ESG terminology, definitions, and labels. One of the unique features of Axioms Investment approach is utilizing a broad set of differentiated data points to integrate ESG into the investment process. Axiom uses a proprietary database to capture, score and rank more than 5,000 operational data points per year that relate specifically to individual ESG factors. This enables them to track how companies are evolving in terms of ESG alignment and to pinpoint the factors most likely generating results over different evaluation periods. Tracking these improvements to stay ahead of the curve is what differentiates Axiom from other managers currently available in Australia.